| Before Trading in Knockout! Warrants Please Note The Following: |

- Ensure you understand the product properly, and have experience in trading derivatives.

- If you are an inexperienced trader don�t trade Knockout! Warrants.

- Buy Knockout Calls if you are bullish, buy Knockout Puts if you are bearish.

- Keep in mind that different Knockout! Warrants will have different Knockout Levels.

- With every investment, one needs to have a time horizon. Don�t buy a Knockout Put listed on an index that you feel might fall in the next 3 months, if the Knockout Put expires in 1 month.

- Once you have entered the position, keep a close watch of the current index level and your Knockout Level.

- Manage the Knockout Level. If the index approaches the Knockout level, we recommend you exit that Knockout whilst it still has value.

- Please note Standard Bank will not be a seller of the Knockout! Warrants close to the Knockout Level.

- Please note the Knockout Level is set off the spot price of the Top40 Tradeable, but Knockout! Warrants are hedged in the FTSE/JSE Top40 Index Future.

|

|

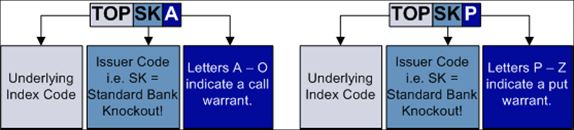

| How to Identify a Standard Bank Knockout! Warrant |

|